Consumer Overweight

Sector Outlook

- Potential tailwind for staples

We like consumer staples next year due to potential tailwind from the key raw materials prices which could uphold consumer staple companies’ margin. We consider more manageable outlook of wheat, coffee, oil as well as CPO, in spite of sugar and dairy products’ prices potential rise. We list out the outlook of each key raw material as follows:

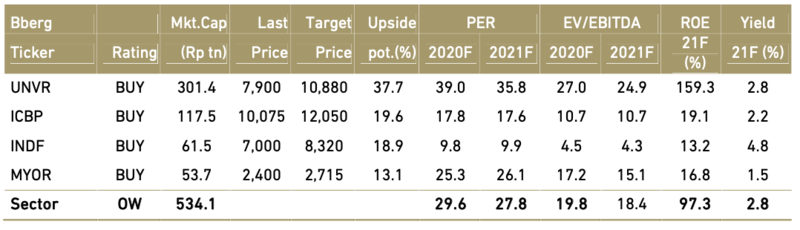

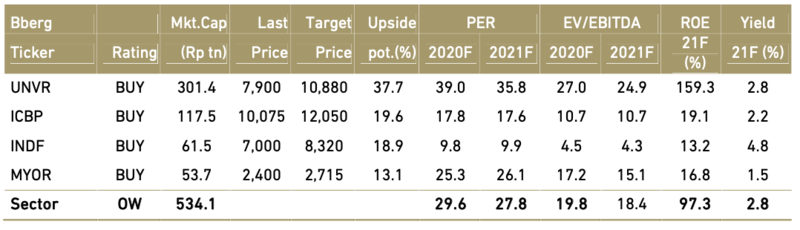

- Wheat: in FY20F wheat price is expected to be manageable despite slightly increase in wheat prices due to weather issue in Europe and central Asia which caused yield losses this year. However, FY19F USDA outlook on global output still expected to grow by 4.7% to 180.8 MT while the usage only grows by 2.8% to 756.3 MT.

- Coffee: coffee price is expected to decline due to oversupply issue with surplus totaling of 4.96 mn bags. If we add the subsequent 2 season’s surplus, the total will be around 7 mn bags, in which translate to 2 years of surplus according to International coffee organization (ICO). 3.9% of global increase in production is almost twice higher than the demand which is estimated to grow by 2.1% YoY in FY20F. We foresee that the coffee price will be in favour for staples’ counters that have exposure to this commodity as we expect the production growth remains high.

- CPO: Our view on CPO price is positive for next year, as our plantation analyst targets CPO price growth at 15% to RM2,300/ton. She notes that the implementation of B20 in FY19F will help Indonesia’s CPO inventory to decrease to below 2.5mn tons level (vs. 4mn tons in FY18). we projects soybean oil price to go up on depleting inventory. Another positive tailwind for CPO price comes from Ex-Java consumption, whereas especially on the low end consumption as farmers will likely to have better purchasing power.

- Oil: Our oil analyst projects FY20F oil price to decline compare to FY19F as he expects that Brent average oil price will decline by 4.8% at USD 60/bbl next year (vs. average USD 63/bbl in FY19F), and WTI average oil price to decline by 3.4% to USD 56/bbl (vs. average USD 58/bbl in FY19F). We view this should be positive for staples margin.

- Potential headwind for staples

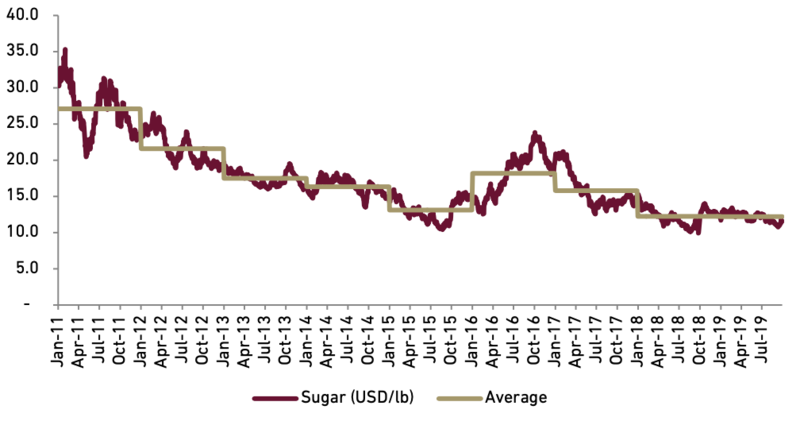

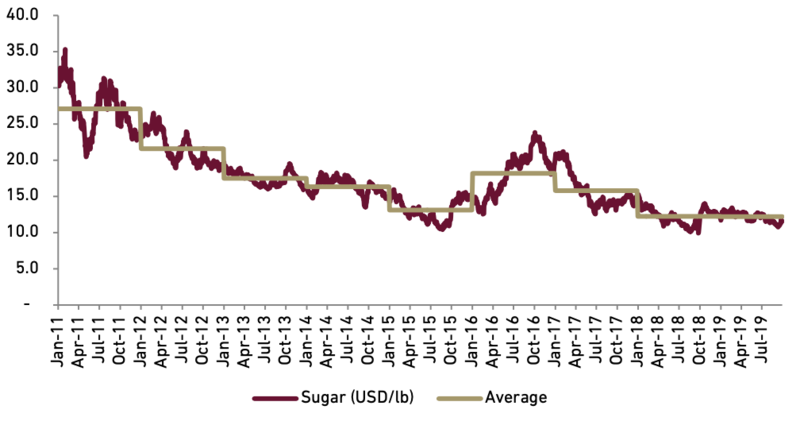

- Sugar: sugar price is expected to increase a little bit in 2020 despite steady decline in FY19F. According to Food and Agriculture Organization (FAO), decline in sugar price is mainly driven by two factors such as: 1). Increasing production in key sugar producing countries such as India and Thailand, and 2). Rising production from Indonesia. On their forecast, Crisil India ( a rating company) expects that sugar price could increase by 8-9% in 2020 due to the delayed rainfall in sugar producing area, and supply from India could shrink by 9-10%. However, there is probability of minimal surge in sugar price since India intention on balancing its supply level by preparing 4 mn tons buffer stock. Looking at the global inventory on sugar Crisil also note that there is huge carry stock of 12 mn tons (vs 7-8 tons average) which should cap the upside on sugar price.

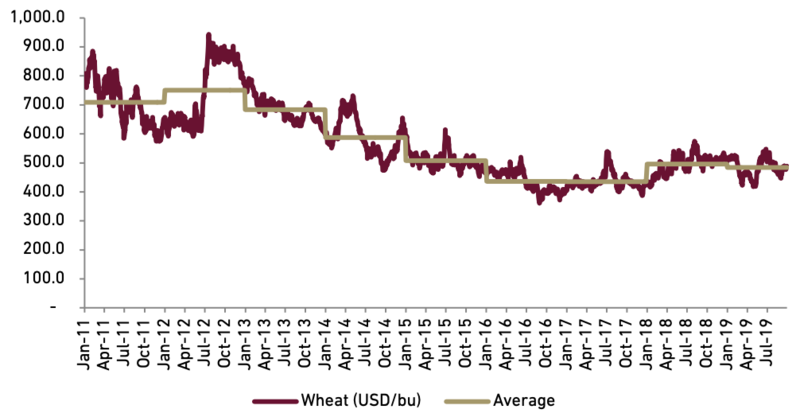

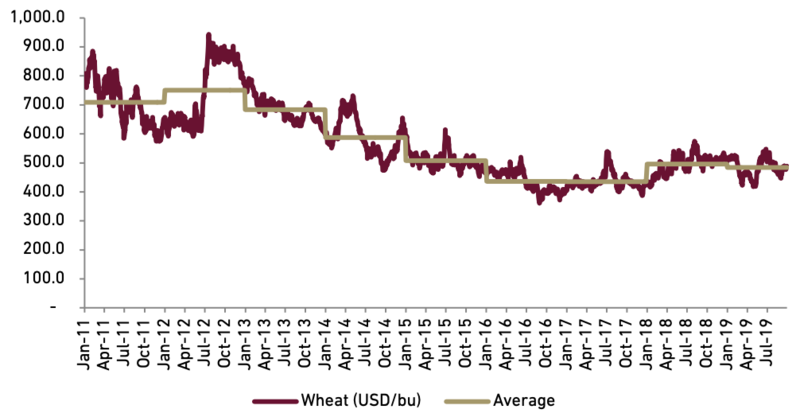

- Dairy: dairy price is expected to rise according to US Dairy Export Council (USDEC) triggered by lower production yield to support export skim milk powder (SMP) from bad weather, and government pressure on low phosphate regulation in EU. Since November 2018 top 5 suppliers (EU, US, New Zealand, Australia, and Argentina) experiencing decline in output and in coupled with increasing china demand. With EU production declined by 1.5% YTD, and New Zealand production cannot offset the decline, the global outlook on SMP price should be rosier and erode company margin with high milk production component.

Exhibit 39: Wheat Price

Source: Bloomberg, Ciptadana

Exhibit 40: Skim Milk Powder (SMP) Price

Source: Bloomberg, Ciptadana

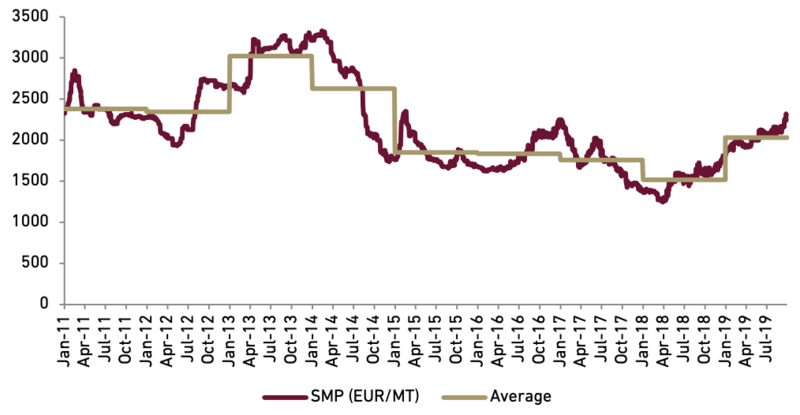

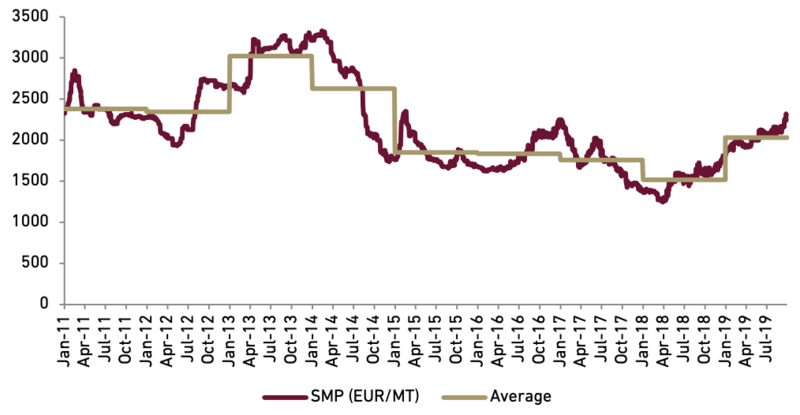

Exhibit 41: Cocoa Price

Source: Bloomberg, Ciptadana

Exhibit 42: Sugar Price

Source: Bloomberg, Ciptadana

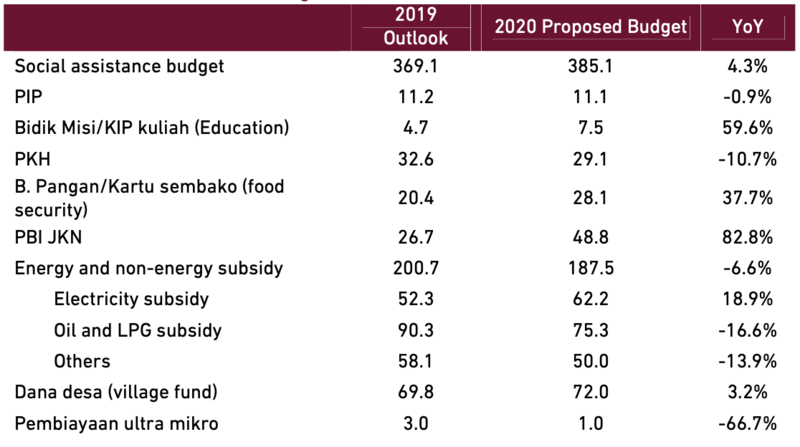

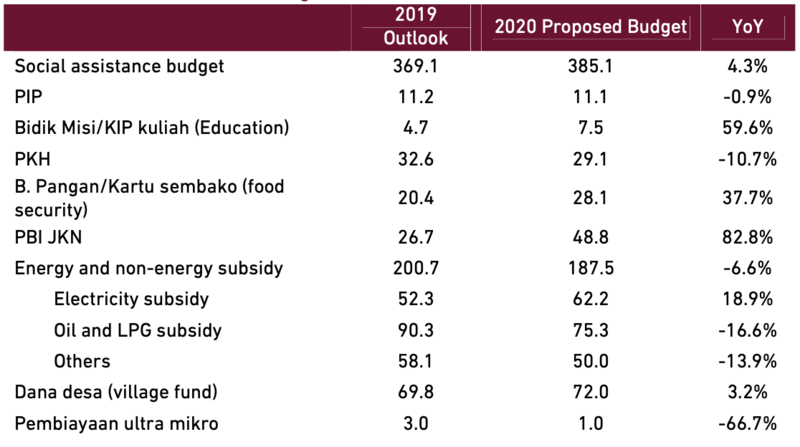

- Mixed bag consumption signal from government budget

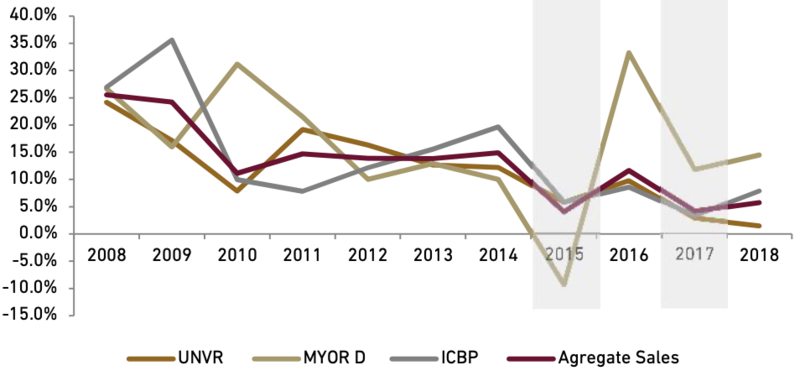

We are receiving mixed signal from government budget which make us more cautious on mid to low income purchasing power, and how it will impact our staples counter. We think staples will face some pressure from low purchasing power on the brink of energy subsidy cut. We note that based on 2015 and 2017 electricity cut we see contraction on staples sales growth during the two periods. Hence we are cautious on the mid to low end purchasing power from the energy subsidy cut despite the increased in social assistance program.

- Social assistance program: social assistance program under PKH and Food security are increased by 7.9% from Rp53.0 tn in 2019 to Rp 57.2 tn in 2020. Digging into the detail PKH (family hope program) is down 10.7% while food security is increased by 37.7%. Thus, we think this is still good for low income household to maintain its consumption for basic necessities since government sending signal that inflation expected to be at 3.1% which means that government will be committed to maintain administered prices steady.

- The energy and non energy subsidy: we saw the budget for energy and non energy reduced by 6.6% with the combination of oil and energy subsidy slashed by 16.6%, mainly from two factors: 1). Government wants to control 3 Kg LPG subsidy and increase oversee effort with aim to make the subsidy more effective. 2). Diesel fuel subsidy is expected to be cut to Rp 1000/Litre from Rp 2000/Litre. However, our concern on the electricity subsidy despite 18.9% increase in total budget, since the government wants to take out electricity subsidy for 900Va category which comprises of mid to low consumer and 23 mn household fall under capable household will be impacted by this subsidy cut. Meanwhile the other 6.9 mn household expected to keep receiving subsidy.

Exhibit 43: Social Assistance Budget for 2020

Source: 2020 RAPBN, Ciptadana

Exhibit 44: Electricity subsidy cuts impacts to revenue in 2015 and 2017

Source: Company, Ciptadana

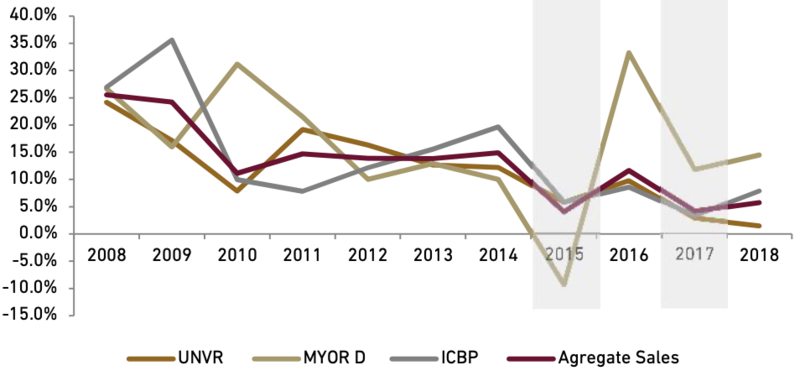

- Preferences pick MYOR, INDF and UNVR.

We have BUY call on MYOR, INDF and MYOR with TP of Rp 2,890, Rp 9,560, and Rp 52,540, respectively. Considering the potential upside on the key tailwind risk for staples margin from low soft commodity price we expect staples to outperform JCI next year.

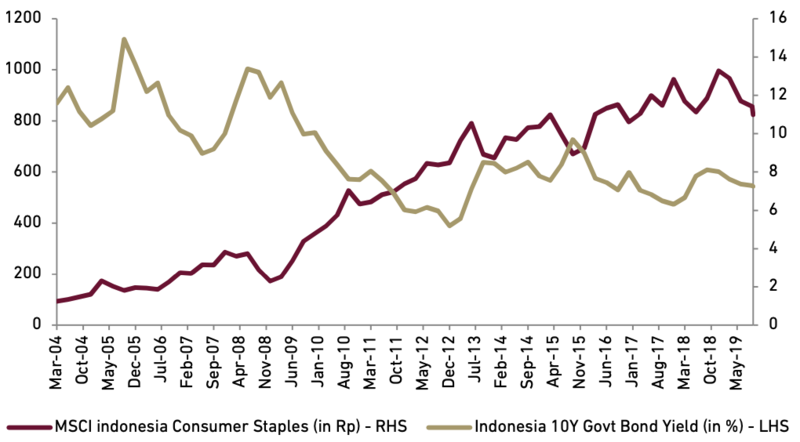

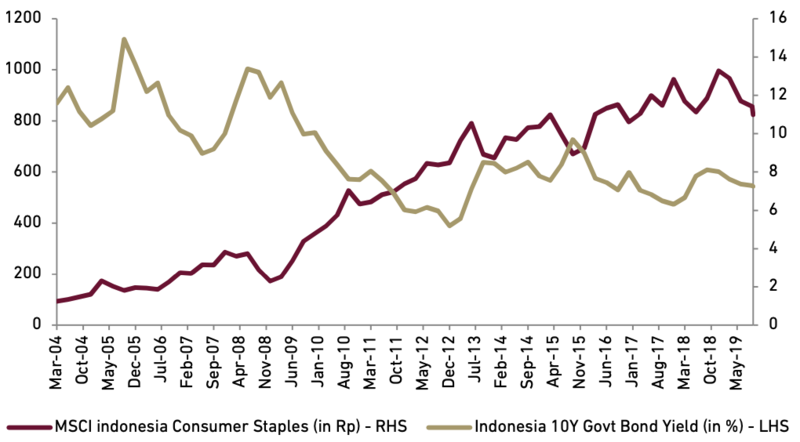

The other drivers for staples to outperform next year from macroeconomic side are 1). As a bond proxy, further cut on interest rate (we found strong relationship with -0.8% correlation between MSCI Indonesia Consumer Staples vs 10Y Indonesia Government bond yield) should support staples valuation to re-rate, 2). Lacklustre on the consumption side especially from low purchasing power consumers (post electricity, LPG, and BPJS contribution hike) as government back to its reform agenda.

Therefore we like consumer names which fit with our 3 criteria’s: 1). Limited concentration to domestic market and having successful foreign expansion. 2) Potential earnings surprise from both commodity prices 3). and names that continue to innovate during intense competition. Our pecking orders are MYOR, INDF, and UNVR. Key rationale as follows:

- We prefer MYOR as our top pick on the back of continuation adding new market to its distribution which will help the company to sustain its organic growth and hedges against the currency volatility. Currently MYOR is traded at 2020F PER of 23.9x , which is near to its -1std of mean , hence we believed the risk and reward are attractive.

- INDF’s valuation is also attractive at 2020F of 14.5 which is below its 5 year historical average (15.0x). Strong ICBP sales and potential earnings surprise are from the agriculture division as we expect higher CPO price and ICBP deliver a decent growth. INDF is also still attractive in term of 40% discount to ICBP.

- UNVR is currently trading at 2020F PER of 42.6x, still slightly below its mean at 46.4x. We like the company as the firm keep adding new product which should fuelling its long term growth on the back of innovation during intense competition.

Exhibit 45: Indonesia MSCI consumer Staples VS 10Y Government bond yield

Source: Bloomberg, Ciptadana Sekuritas

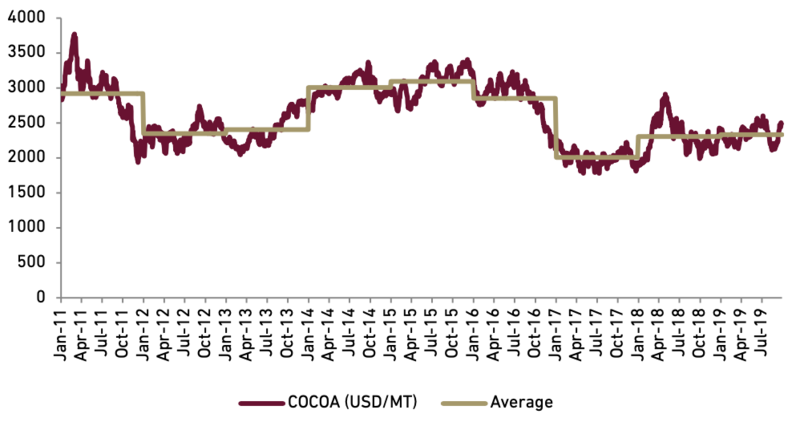

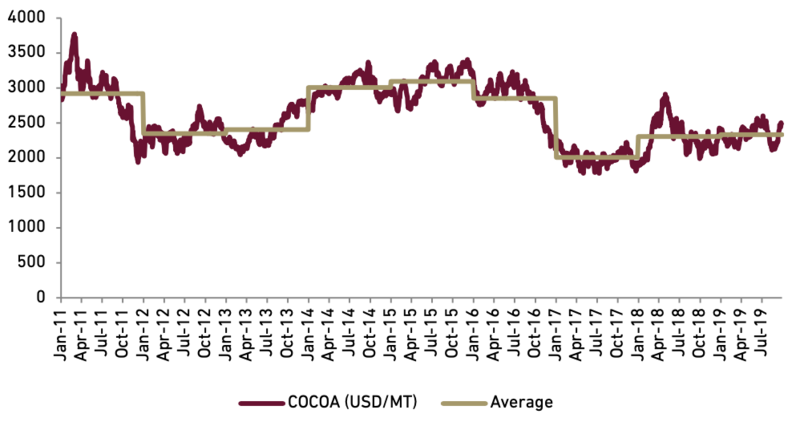

Exhibit 46: Consumer stocks rating and valuation